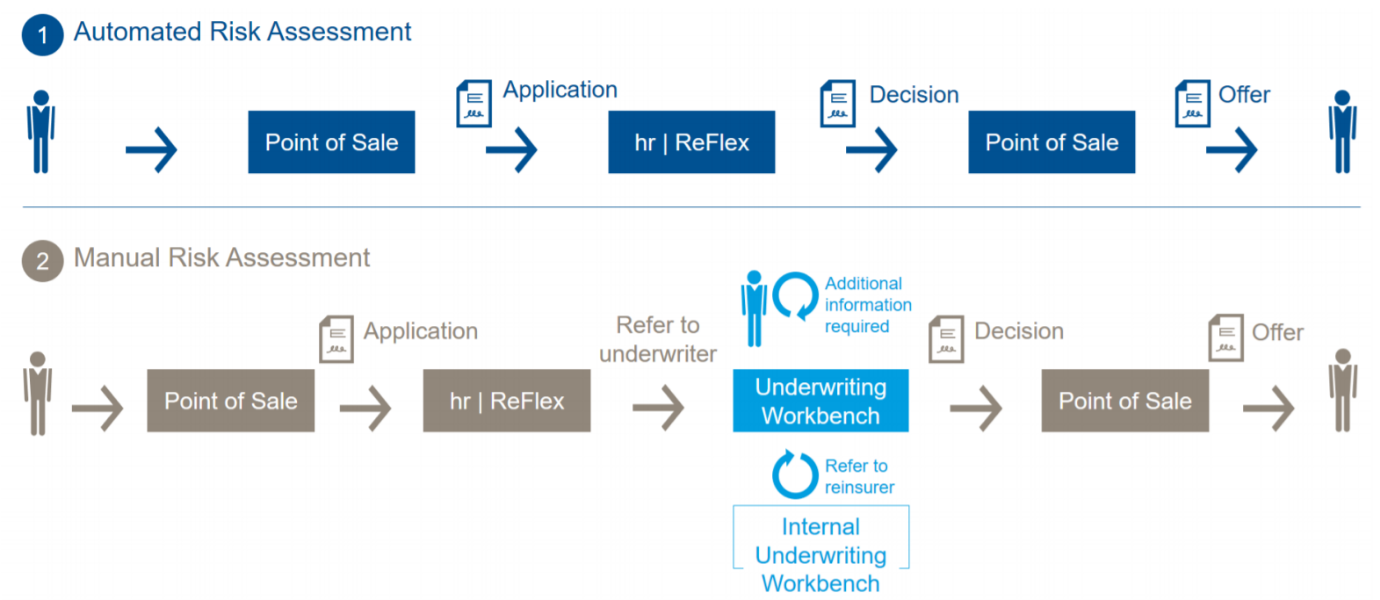

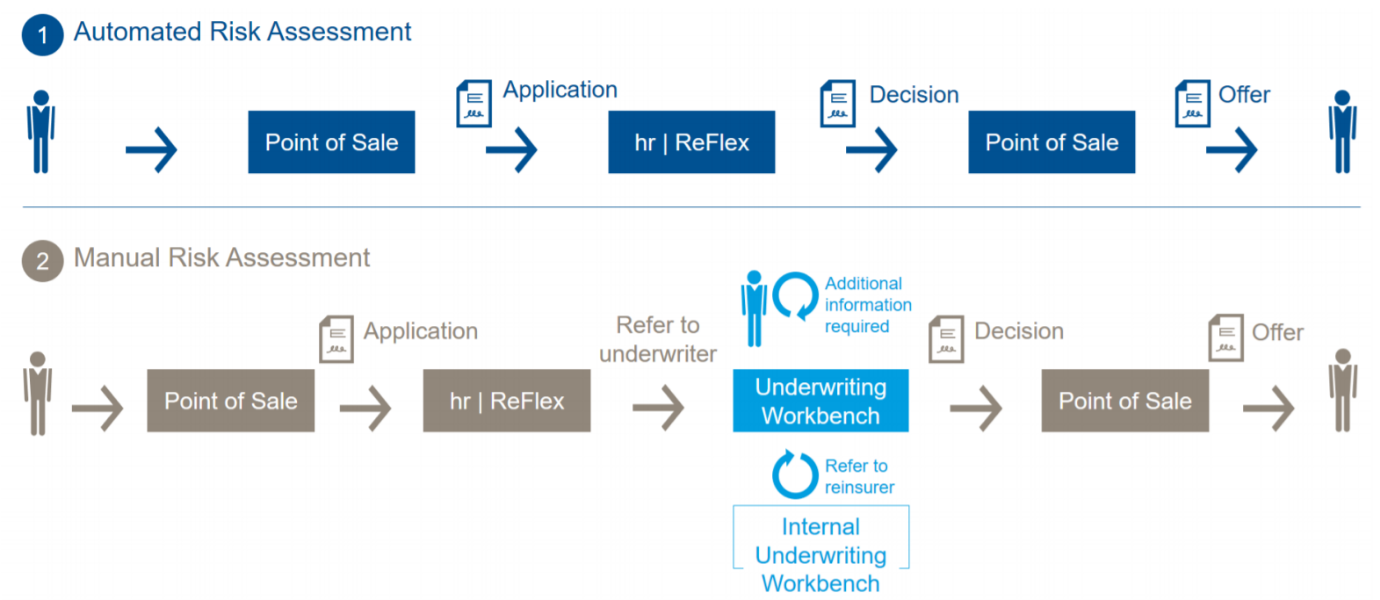

eUnderwriting & Instant Risk Evaluation

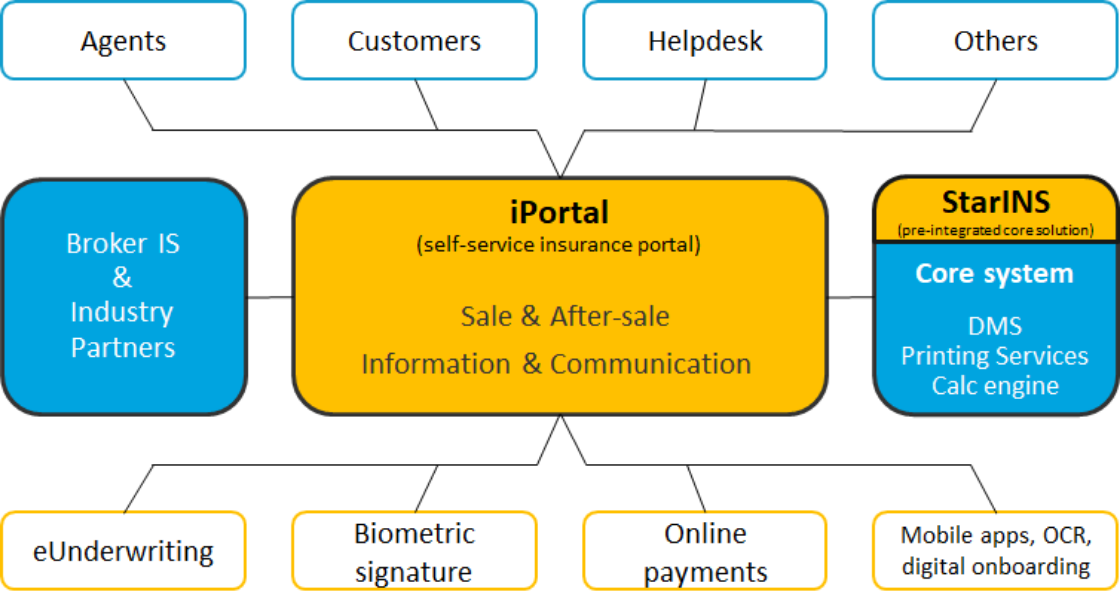

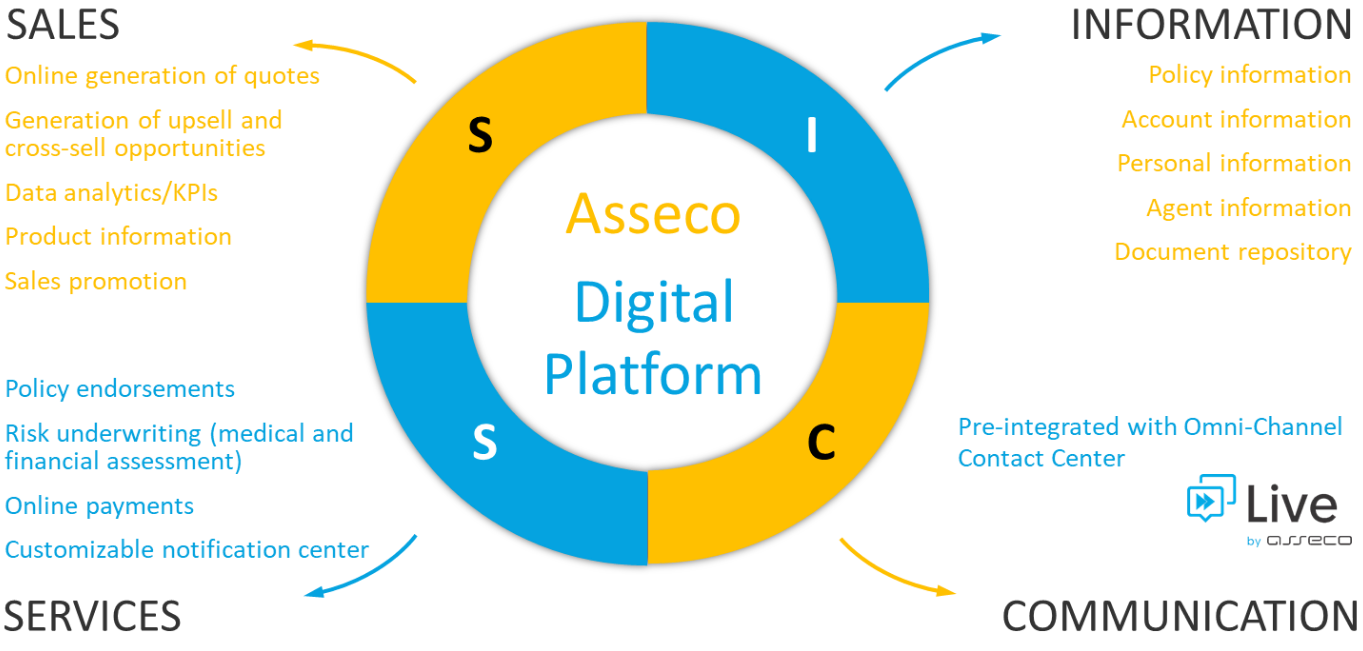

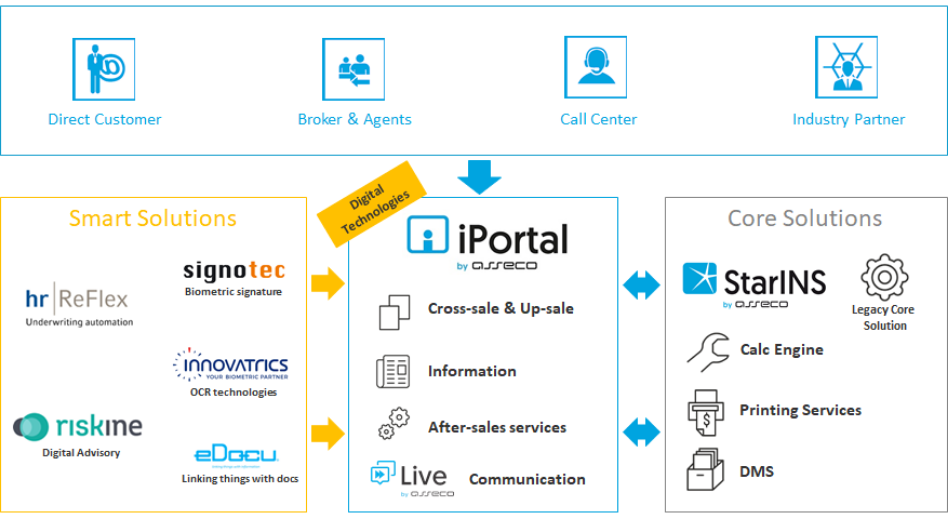

The Asseco Digital Insurance Platform represents a multi-sided platform bringing together different “consumers” from insurance industry to benefit from newest technologies, facilitate information exchange, streamline sale and after-sale processes, improve customer relationship and loyalty.

The goal of the platform is to help insurance companies accelerate on its digital transformation journey.

The platform is equipped with REST API service layer enabling seamless integration to third-party solutions.

The Asseco Digital Platform is open for integration with other third-party solutions such as back-office solutions, smart solutions supporting AI and machine learning technologies and more.

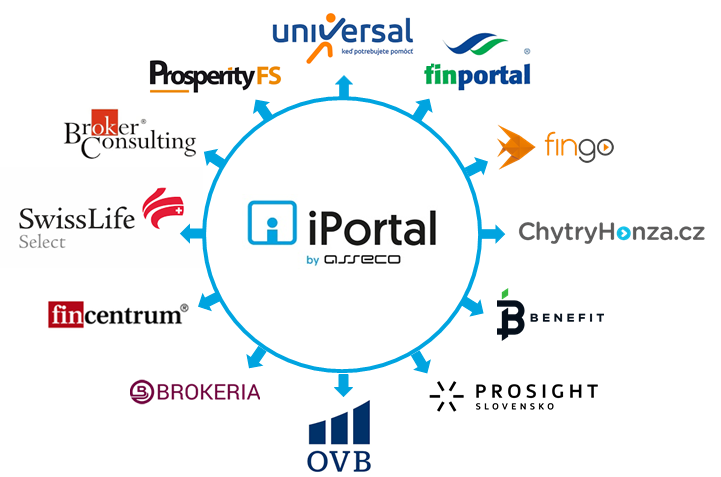

The platform has been integrated with sales portals of the largest brokerage houses across Czech Republic and Slovakia based on SSO technologies

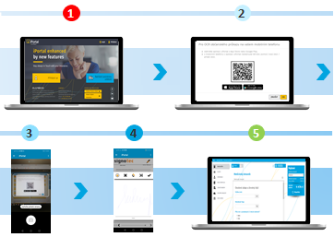

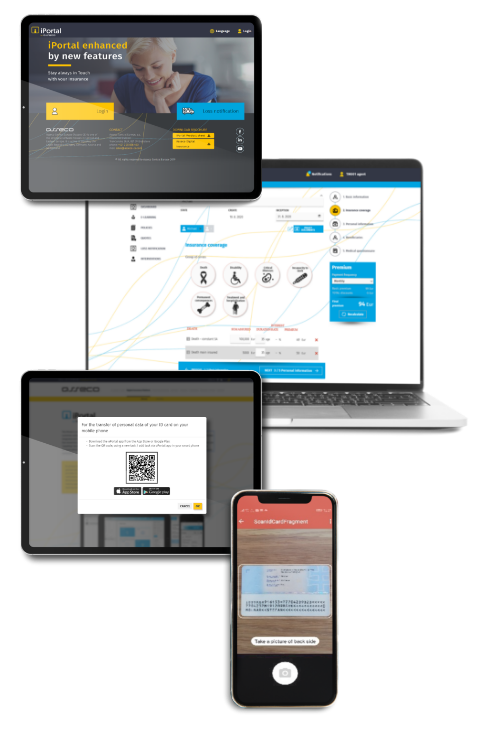

The basic component of the platform is the iPortal – a responsive self-service front-end solution that streamline sales processes and minimize back office operations by “expelling” the most requested services to the portal.

The platform is further pre-integrated with Asseco’s core back-office solution called StarINS serving life, non-life and composite insurance carriers, supporting all lines of business and covering the most of back office operations present in the insurance business. One of the advantages of being integrated with StarINS is use of shared services of calculation engine (one source of truth), printing services as well as DMS.

The integration platform consisting of iPortal and StarINS we call IooX (Insurance out of the box) representing an end-to-end software suite covering the front-end and back-office operation of a commercial insurance carrier (i.e. life, non-life and composite insurance).

Now available also as cloud solution.

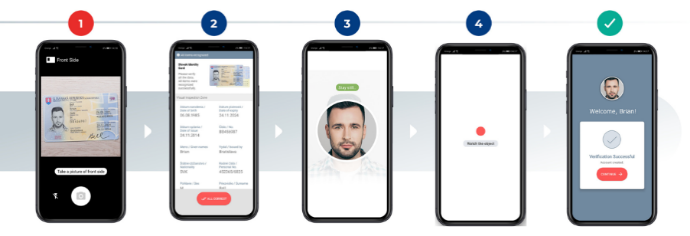

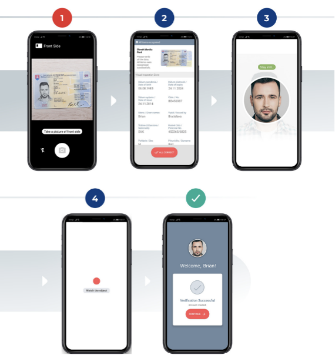

Currently the platform integrates smart solutions supporting